Between sixty and ninety days before the anniversary of an insurance policy, an insurance agent will usually sit down with their client to discuss any changes in the customer’s business or market sectors to see if their insurance needs have changed before drawing up a new policy quote. Getting the best insurance coverage really depends on how good the information is that agents receive, and no one knows the ins-and-outs of event production better than you—so make sure to tell your story.

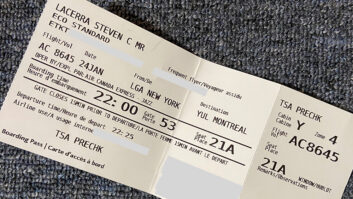

You can take control of the insurance process by putting forth your own narrative instead of letting the agent drive the dialog by asking generic questions. For instance, consider what might have changed at your company in the last year. Did you purchase new equipment? Did you integrate new technologies, and how do they impact potential liabilities for your employees and customers? All of these factors can and should be addressed within an insurance policy.

Additionally, live event producers should address any losses accumulated throughout the year. Identify the type—anything from stolen equipment, to being unable to do business because of a burst pipe. Address how these incidents happened, and what the cost was to fix it. Additionally, address what new processes and procedures have you put in place to make sure they don’t happen again. The ball is in your court to analyze the past and evaluate your own risks—the same risks that you will be asking an insurance company to take on in the event of a loss.

You’re also the best person to tell an agent about changes in your industry’s environment. Have there been any significant new regulatory or legal changes that could affect liability? Has the industry or sector experienced an economic downturn, or has it seen a spike in demand? Sometimes too much business can be as challenging as not enough, stretching your manpower and other resources that could lead to problems as you work harder to meet increased demand.

On the other hand, have you implemented new policies, initiatives and procedures that have enhanced safety? Have your colleagues and employees taken and been certified for new qualifications that can reduce various kinds of risks? Have you improved your company’s security systems, which will reduce the chances of theft (or what the retail industry euphemistically refers to as “shrinkage”)? These are the kinds of things that tell an insurance company that you’ve been proactive in reducing risk for your company in the last year.

They also comprise the kinds of tales that your insurance agent needs to hear, and that he or she can relate to others in the process who will help assemble the most relevant insurance products and most cost-effective premium structures for it. It’s a story no one can tell better, and it can help assure a very happy ending.

Scott Carroll, executive vice president & program director for Take1 Insurance, has more than 30 years insurance industry experience. Since 2008, he has built Take1 Insurance, the entertainment division of US Risk, with a focused concentration on event service-related insureds who support the live entertainment community.