Orlando, FL (June 16, 2023)—Between courses at Tuesday’s Market Insights Lunch at InfoComm 2023, one message remained clear: The Pro AV industry is solid and should remain so for the foreseeable future—but does that mean we are returning to normal?

According to Sean Wargo, vice president of market intelligence for AVIXA, things have changed since the pandemic, which means normalcy has also changed. With recession risks ebbing and flowing, he expects the Pro AV industry to grow back to pre-pandemic levels, as well as return to a steady state of modest growth. Compared to EMEA, the Americas had stronger growth in 2022, as in-person activities surged back. In 2023, however, AVIXA expects the Americas to see lower growth than other parts of the world.

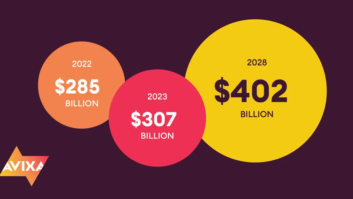

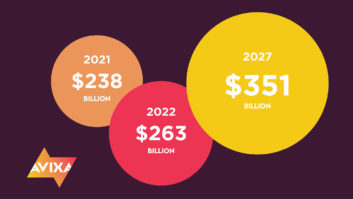

AVIXA estimates the Pro AV industry will bring in $307 billion this year, and Wargo anticipates it will add nearly $100 billion more in annual revenue by 2028. In comparison, the IT industry is already close to $5 trillion, while the consumer electronics industry accounts for $1 trillion. “As an industry,” he noted, “we are small but mighty.”

Most Pro AV market segments will grow over the next five years, though results will vary. Conferencing and collaboration still lead Pro AV, with learning, digital signage, content production and streaming and performance/entertainment rounding out the top five market segments. Notable product segments include standalone software (up 11.6% annually through 2028) and control collaboration in-room technology (up 8.5% annually through 2028). Meanwhile, video projection is expected to drop by 3% per year in the same time horizon.

AVIXA to Champion Diversity, Equity and Inclusion at InfoComm 2023

Beyond Pro AV, there is short-term economic weakness, but the long-term looks stronger. AVIXA economist Peter Hansen said growth in the Americas came in below expectations in 2022, and the latest estimates for 2023-2024 are also low. “There continues to be a very real possibility of a recession,” Hansen added. AVIXA figures a U.S. recession is a 50/50 shot at this point, but the good news is that a recession—should one happen—would likely be mild.

While supply constraints were severe in 2022, those issues are easing. However, Pro AV sees a shift from CapEx to OpEx. As Hansen explained, high-interest rates and the increased cost of up-front cash entice companies to pay for AV as an operating expense, with managed services a top factor. Higher borrowing costs could also lead to less construction and more adoption of cloud solutions. These shifts could open the door to more IT integrators in the market, though Hansen is confident that AV integrators will remain competitive.

As the hybrid workforce continues to develop, there may be some cause for concern—not panic—with regard to office space. U.S. office rent is actually showing a slow and steady increase, so it is far from a disaster, and the data show higher quality properties are in higher demand. Even if square footage declines, Wargo explained, the net could be good for Pro AV, as the number of AV-intensive conferencing solutions will likely increase in number.