Santa Ana, CA (September 13, 2011)—In the wake of numerous staging accidents that took place this summer at outdoor festivals, lawmakers and the industry are calling for changes. According to Scott Carroll, Executive Vice President of Take1 Insurance, one of the things that have to be re-evaluated is the approach to insuring such events.

Weather-related stage and equipment collapses occurred at the Indiana State Fair in Indianapolis, the Cisco Ottawa Bluesfest, the Brady Block Party in Tulsa, Oklahoma and Pukkelpop Festival in Belgium. Carroll noted, “As musicians continue to expand their touring seasons, to make up for lost revenue from declining album sales, it is increasingly important for all parties involved to have specialized insurance in case of an incident, especially for outdoor events. Weather is always a factor in stage design as well as in our insurance risk assessment. As evidenced by several unfortunate incidents this summer, extreme weather is becoming more commonplace, so touring and production companies simply cannot afford to risk not insuring the stage, sound, lighting and video equipment that is often worth into the millions of dollars.”

Carroll contends that with all of the planning and engineering that go into these stunning stage designs, a comprehensive insurance policy is as important as the equipment itself. While noting that insurance for an outdoor event is not the same as insurance for a company that sometimes performs or works at outside events, he also pointed out that as staging systems are increasingly upgraded to bring the look and feel of indoor events to the outdoors, and that the insurance industry needs to study the underwriting issues and learn new questions that need to be addressed, as well as possibly introducing stricter risk mitigation requirements from clients.

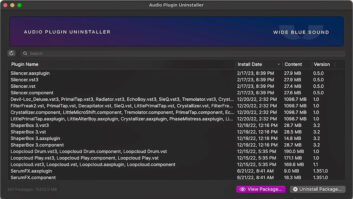

Carrol noted that Take1’s specialty program has designed inland marine coverage, among other specialty coverages for the entertainment industry, that automatically applies everywhere in the world, without the need for additional riders or endorsements. It eliminates co-insurance, thus protecting 100 percent of the insured value of the equipment covered; provides automatic replacement cost valuation; allows for separate limits in key individual coverage areas like owned equipment, equipment rented from others, equipment in the insured’s Care Custody and Control (CCC), and equipment in transit; flood coverage for equipment in transit; and blanket limits that eliminate the need for clients’ to itemize each and every piece of equipment, cable, LED panel, etc. being covered.

U. S. Risk Insurance Group, Inc.

www.usrisk.com