The market for pro audio products in professional and home studio applications posted global revenues of more than U.S.$1.2 billion for 2018, an increase of over 6 percent, according to an industry report from Futuresource Consulting. Covering mixers, mics, audio interfaces, studio monitors and professional headphones, the report describes continued growth in volume and value out to 2023, at a CAGR of 9.7 percent and 6.5 percent, respectively.

Professional and Home go Head-to-Head

Pro audio products operate in a dynamic market, with increasing competition between professional and home use. The home content creation space is flourishing.

The home studio segment is now responsible for more than half of total studio vertical revenue and the numbers are climbing. One result of this revolution has been the disappearance of many small- and medium-sized recording studios, but these have been replaced by millions of amateur musicians, podcasters, streamers and content creators, working from home studios and fueling a high-growth market for pro-audio hardware and software. Despite the challenges faced by pro studios, a new ecosystem is now emerging, where professional and home studios are complementing and supporting each other.

Anatomy of a Home Studio

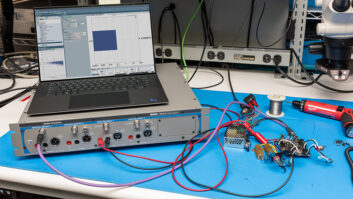

Home studios tend to be built around one of five user types, namely podcasters, vloggers, gamers, musicians and producers. As a starting point, they can consist of anything from a USB microphone connected to a PC running amateur recording software, to mixer consoles and higher value pro audio equipment.

Podcasters are driven by the desire to have their voice heard, usually aiming to be informative or provide practical benefit. They begin with a USB microphone connected to a PC, running basic editing software. Estimates from leading podcast producer, Midroll Media, put the number of people in the U.S. listening to podcasts at 67 to 68 million in 2017, which is nearly one in four people across the country, up 45 percent from 2015.

Vloggers and video publishers are driven by the desire to go viral, express opinions, demonstrate a talent or provide information. They often begin with just a smartphone, possibly with a microphone connected. More advanced users are likely to spend on camera equipment and then purchase a shotgun, lavalier or camera-mounted microphone.

Musicians are driven by the need to record their instruments and voice, starting off with a microphone (often an XLR condenser mic), an audio interface, a set of headphones and recording software. There has been a trend over the past 20 years of using home-based studios for serious music production.

Growth of the home studio market is being helped by professional artists setting up home studios and by amateurs pursuing content creation with entry-level products, and by those same entry-level users upgrading to more advanced solutions later on.

The Long View

Many home studio owners are on a long-term purchasing journey, seeking to upgrade to better equipment or add additional kit to their studio. Today’s buyer of entry-level products will be tomorrow’s buyer of mid-range products, transitioning towards the purchase of high-end products. With the sheer volume of growth in the home studio segment, this purchasing behavior is a key factor driving the mid-range and higher end of the market.

Word from the End User

Futuresource conducted an international survey of home studio owners in December 2018, to better understand this dynamic customer set. Covering France, Germany, Italy, U.K., Canada, U.S., Japan, South Korea, China, Australia and Brazil, the survey also explored the purchase triggers and touch points that exert an influence on home studio owners.

It’s no surprise that social media has become an important influencer and an increasingly significant marketing tool. By far the most influential source of information mentioned by survey respondents is video reviews found on YouTube and other sites, cited by over half the respondents. They watch for the types and brands of kit that professionals are using and then buy it online. YouTubers often create reviews of products through their own volition, though reviews of studio setups are even demanded by fans of the content creators. Almost all brands in this space report spikes in sales due to these reviews, and many are endorsing creators.

Nearly a third of respondents mentioned ratings and reviews at online retail sites, highlighting the extent to which home studio buyers are purchasing online and the importance of how a product is presented and positioned on those sites.

The survey also indicated that people are buying more equipment and using it more. Fifty-four percent say they used their home studio equipment more than last year. When asked why usage had increased, 77 percent chose options relating to their ownership of better or more affordable hardware or software.

Broadcast and Game Content

Although home studios are competing in the music studio, podcast and vlogger space, creation of broadcast and game content remains largely the reserve of professional studios. Demand for both types of content continues to grow significantly, particularly games, driving value for studio equipment vendors in the professional segment.

Games typically require 3D audio, a higher quality of which is required if a game hopes to become popular and achieve a foothold in the lucrative esports market and 3D sound is also vital for VR games. Our research in content markets indicates that worldwide consumer spend on games exceeded $130 billion in 2018, an increase of more than 10 percent compared with 2017. Against the backdrop of all this consumer activity, game developers are putting more money and resources into providing high-quality audio, including in-game music, voiceover and sound effects. It’s all great news for pro audio vendors.

A Complex Business Challenge

The sheer range and diversity in the customer base for professional audio equipment, from individuals buying online to large corporations making high-value purchases, means that suppliers need to manage an array of marketing models to stay on top. From the differing usage requirements, influencers and channel dynamics, it’s a balancing act between nurturing growth markets at the low-end, while maintaining brand position and capturing value at the high-end.

This business challenge is a complex undertaking, with many of today’s entry-level users becoming tomorrow’s high-end spenders, vendors need to take purchasers on a journey from first principles, guiding them through the decision-making process from entry level onwards, without eroding premium-brand equity over the long term.

To understand more about the “Home and Professional Studio Report” download the Futuresource Consulting infographic showing the typical user cases for home studios at https://www.futuresource-consulting.com/free-content-analysis/professional-av-downloads/.